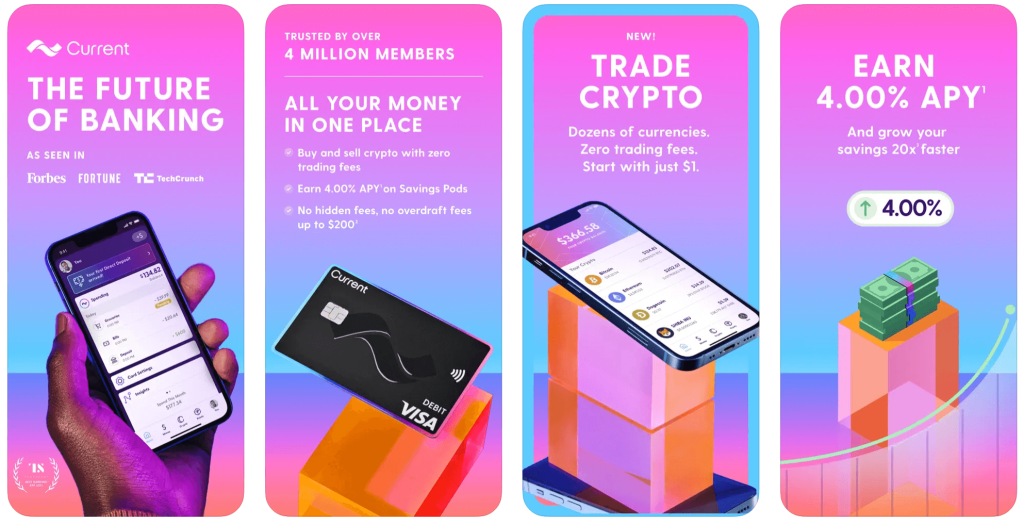

Current is a mobile-based financial technology company that offers baking services and has roots in New York City. The app allows access to its accounts only via its mobile app.

Banking services provided by Current are all done through partnerships with Metropolitan Commercial Bank and Choice Financial Group, Members FDIC.

Current provides accounts that combine the savings and checking components in banking. As a Current user, you can set up a basic account for yourself without having to pay any membership fees.

Current allows you to open a Basic account as well as opt for a Premium account; you can also set up Teen accounts for your kids through this app.

Features

- Current’s Basic App doesn’t require you to pay any membership or monthly fees. The basic debit card allows you to access more than 40,000 fee-free ATMs via the Allpoint ATM network across the country.

- Current provides a Savings Pod within your account (either Basic or Premium) that allows you to save for your future goals.

- The app comes with a Budgets feature that helps you to create a budget to track your expenditure. Premium account users can create multiple budgets and create a maximum of three Savings Pod.

- The Round-Ups feature helps you to maximize your savings with your Current Debit Card. This feature works by rounding up your purchase amount to the nearest dollar. The difference then gets transferred to your Savings Pod.

- Users can also earn cashbacks and rewards through the Current Points feature. By making purchases with your Current card, you earn points redeemable for cash.

- If you are a Current Premium Account user, then you are eligible to receive direct deposits upto two days early.

- For the teen accounts, parents receive notifications for every purchase, and can also block purchasing via specific merchants.

- Premium account users can also overdraft up to $100 on Current debit card purchases without having to pay overdraft fees via the Overdrive feature.

Pros

- As a Basic account user, you wouldn’t need to pay any monthly fees or other fees.

- Current allows its card holders to access more than 40,000 network ATMs all over the country without having to pay any surcharge fees.

- Teen accounts feature helps to provide teens with some sense of financial freedom while also giving partial financial control to the parents.

Cons

- The biggest con about using Current account is that it does not provide any kind of interest on your savings.

- You can only access Current’s financial management features through the app. No in-person service is provided by the company.

Download Current App

Conclusion

Current mobile banking comes with great features for users to get on board with online financial management. Its user interface is pretty simple and easy to use.

Features like Budgets and Current Pay (peer-to-peer payments) are great to help you plan budgets and make payments. The app also considers payments made via Google Pay and Apple Pay.

If you are looking for a mobile app that provides digital banking services and helps plan your monthly spendings, Current is the right choice for you.