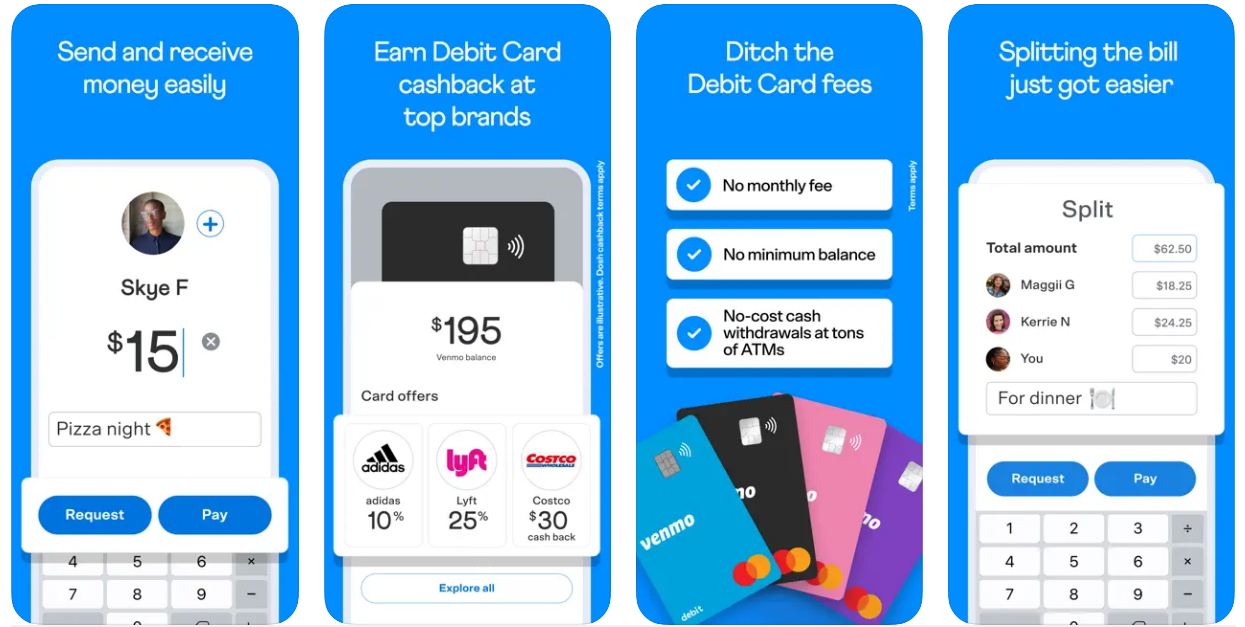

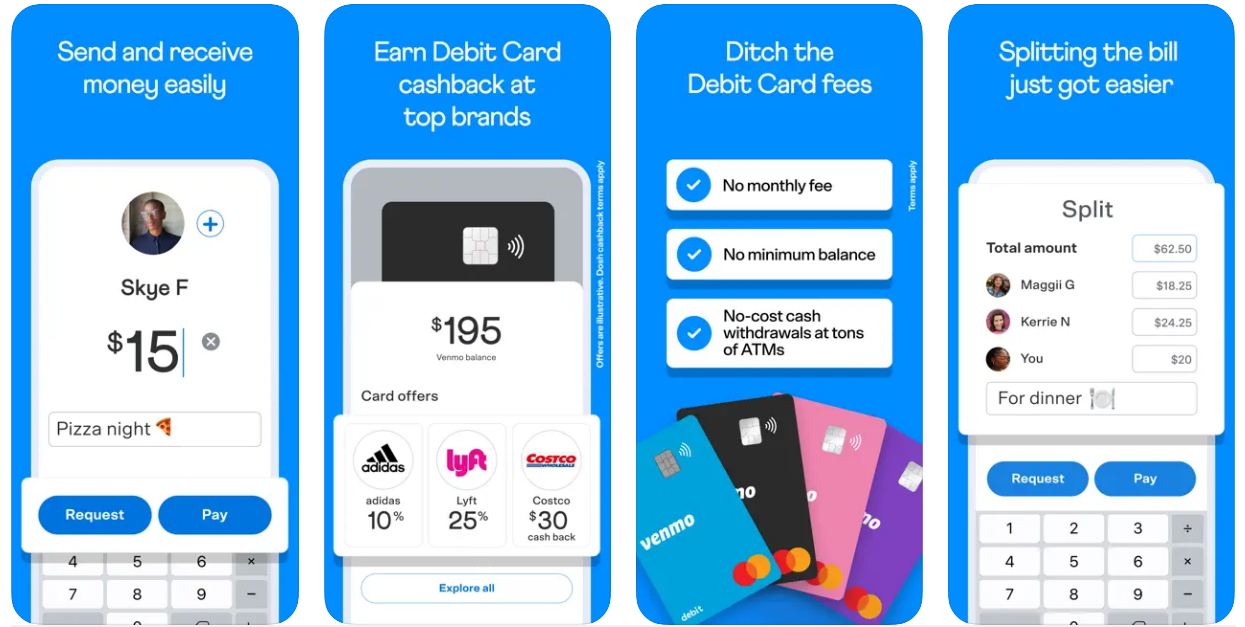

Venmo is a popular mobile payment app that makes sending and receiving money a breeze. It allows users to pay friends, family members, or even businesses effortlessly with just a few taps on their smartphones. Available for both Android and iOS devices, this easy-to-use app enables fast and secure transactions, while also allowing users to track and manage their spending habits. With Venmo, users can split bills, repay loans, and even settle dining tabs without needing cash or breaking a sweat. So whether you are sharing the cost with your friends or paying your favorite local business, Venmo has got you covered!

Features

- Peer-to-peer transactions: Easily send and receive money from friends, family members, or anyone with a Venmo account.

- Bank and card linking: Link your bank account, debit card, or credit card to your Venmo account for seamless transactions.

- Secure payments: Venmo uses encryption to protect your account information and monitor transactions for unauthorized activity.

- Venmo balance: Maintain a balance within your Venmo account to quickly send payments without utilizing your linked bank or card.

- Request payments: Send payment reminders to others for unpaid expenses or loans.

- Payment history: Access detailed records of past transactions for better expense management.

- Venmo QR codes: Easily scan another user’s QR code or share your own to streamline payments and friend requests.

- Instant transfer: Transfer funds from your Venmo balance to a linked debit card or bank account within minutes for a nominal fee.

Remember that even though the Venmo app offers a range of useful features, keep in mind that users must be 18 years or above and reside in the United States.

Pros

- Convenience: Sending and receiving money is easy and quick with just a few taps on your smartphone.

- Splitting costs: The app simplifies the process of splitting expenses among friends, making it easy to share the cost of bills, eating out, or outings.

- Social aspect: The social feed adds an interactive element to the app, allowing users to see their friends’ transactions and stay connected.

- Wide adoption: As a popular mobile payment service, many users have Venmo accounts, making it more convenient to send and receive payments.

- In-app purchases: With an increasing number of businesses accepting Venmo, users can conveniently shop and pay using the app.

Cons

- Limited availability: Venmo is only available to users in the United States who are 18 years or older, limiting its applicability for some individuals.

- Fees: The app charges fees for instant transfers and certain payment methods such as credit cards.

- Privacy concerns: The social feed may inadvertently reveal transactions you may have preferred to keep private unless you adjust your default privacy settings.

- Not ideal for large transactions: While suitable for smaller transactions, Venmo may not be suitable for large payments, as it has transaction limits.

- Risk of scams or fraud: Scammers may take advantage of the platform to request money or pose as sellers, making it essential for users to be cautious and verify transactions before proceeding.

Download Venmo App

Conclusion

The Venmo app has become an essential tool for smooth and easy peer-to-peer transactions. With its ability to split expenses, send and receive money, and make in-app purchases, it offers a highly convenient and widely adopted solution for mobile payments. The app’s social aspect adds an engaging element, while advanced security features protect users’ financial information.

However, it’s important to keep in mind that Venmo is limited to users in the United States and may not be ideal for large transactions due to certain limits. Users should also be cautious of potential scams and be mindful of privacy settings to ensure their transaction history remains confidential. Despite these caveats, the Venmo app remains a popular choice for securely managing payments among friends and family or with participating businesses.