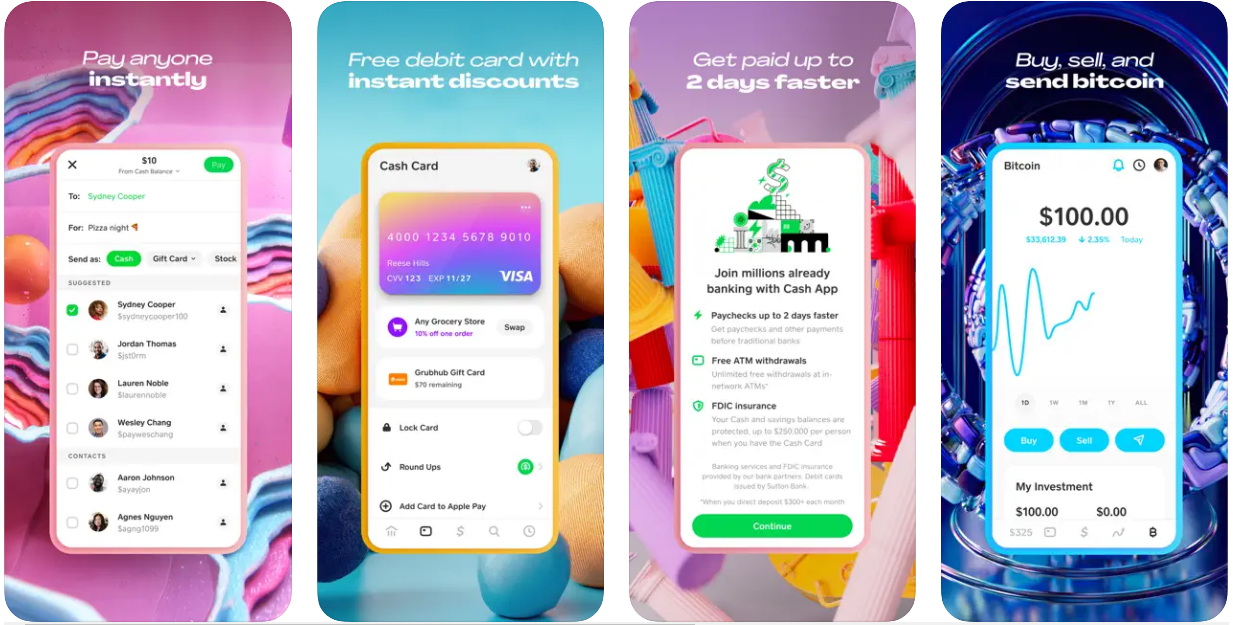

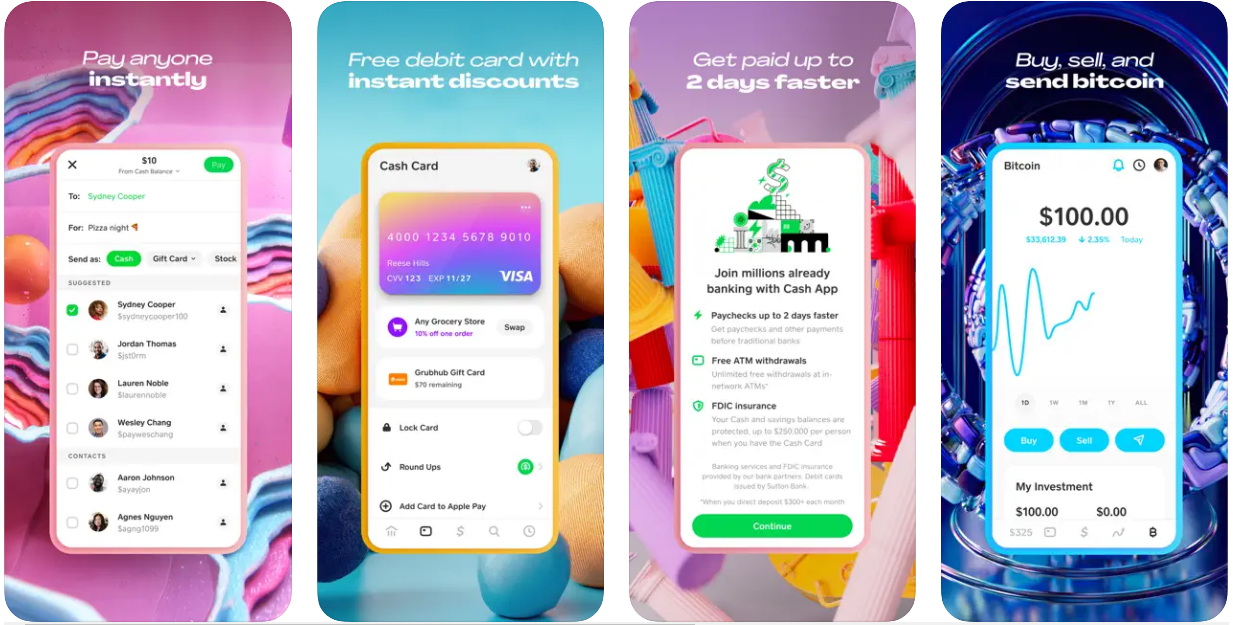

Cash App is a mobile payment service developed by Square, Inc. that allows users to easily send and receive money from friends, family, or businesses. Launched in 2013, it has become a popular alternative to traditional banking methods for its simplicity and convenience.

Features

- Instant money transfers

- No monthly fees

- Easy-to-use interface

- Optional Cash Card (a customizable debit card)

- Boosts (discounts on select purchases)

- The ability to buy and sell stocks and cryptocurrencies

- Fundraising options through Cash App $cashtags

Using Cash App is as simple as downloading the app, linking a bank account or debit card, and then sending or receiving payments via your smartphone.

Pros

- Fast and easy transactions: Money transfers between Cash App users are nearly instant, making it convenient for splitting bills, sharing expenses, or sending funds to friends and family.

- No monthly fees: Unlike many traditional banks, Cash App does not charge monthly fees, making it an affordable solution for money management.

- User-friendly interface: The Cash App’s clean, intuitive design makes it simple for anyone to use, even those with limited experience using digital payment platforms.

- Customizable Cash Card: The optional Cash Card serves as a debit card linked to your Cash App Balance, allowing you to make purchases and ATM withdrawals. You can also customize its design.

- Boosts: Cash App offers unique cash-back and discount opportunities on select purchases using the Cash Card. Boosts can be applied to restaurants, coffee shops, and other retailers.

- Investing options: Cash App enables users to invest in stocks and cryptocurrencies directly from the app, bringing investment trading to a wider audience.

- Compatibility with iOS and Android: Cash App is available for both iOS and Android devices, making it a flexible option for users across different platforms.

- Fundraising capabilities: Cash App’s cashtags make it possible to raise money for personal causes, events, or charities by simply sharing your unique cashtag.

While Cash App offers many benefits, it’s important to keep in mind potential drawbacks, such as transfer fees when sending or receiving money internationally, or the limited customer support options.

Cons

- Limited international availability: Cash App currently supports transactions only within the United States and the United Kingdom, making it unsuitable for users who frequently send or receive money internationally.

- Fees for instant withdrawals: While Cash App offers free standard withdrawals to your bank account, there is a fee if you choose the instant withdrawal option, which can be up to 1.5% of your withdrawal amount.

- Spending limits: Cash App imposes some limits on transactions, including daily and weekly spending limits, which might be insufficient for users with high spending or withdrawal needs.

- Potential security risks: As with any digital payment platform, there is always the risk of unauthorized access or scams targeting users. Ensuring account security and being cautious when sharing personal information are crucial.

- Limited customer support: Cash App’s customer support is primarily available through the app or website, with no direct phone support. This might be an inconvenience for some users who prefer speaking directly to a representative when facing issues.

- Lack of advanced banking features: Cash App might not provide all the services offered by traditional banking institutions, such as loans, cashier’s checks, or in-person branch support.

Weighing the advantages and disadvantages of Cash App is essential to make an informed decision about whether it is the right platform for your specific financial needs.

Download Cash App

Conclusion

Cash App offers a simple, convenient, and user-friendly solution for sending and receiving money, managing finances, and even investing in stocks and cryptocurrencies. With its intuitive interface, no monthly fees, and unique features like the customizable Cash Card and Boosts, it has gained popularity as a modern alternative to traditional banking methods.

However, it’s important to be aware of the limitations and potential drawbacks of using Cash App, such as limited international availability, fees for instant withdrawals, spending limits, security risks, and lack of advanced banking features.

When deciding whether to use Cash App, carefully consider your individual financial needs and priorities, as well as the potential risks, in order to make an informed decision. Cash App may be a great fit for those looking for a simple way to manage money and complete transactions, but it might not be ideal for users needing more comprehensive financial services or those who regularly deal with international transfers.